Alcoa Inc. (NYSE: AA), the largest U.S. aluminum producer, is scheduled to release its fourth quarter earnings after the closing bell on Tuesday, January 7, 2013. Analysts, on average, expect the company to report earnings of 6 cents per share on revenue of $5.60 billion. In the year ago quarter, the company posted a loss of 6 cents per share on revenue of $5.99 billion.

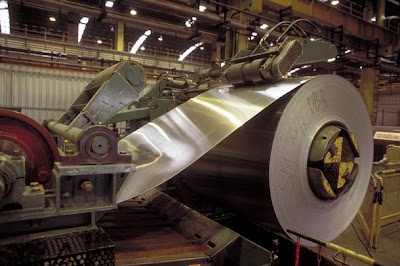

Alcoa Inc. engages in the production and management of primary aluminum, fabricated aluminum, and alumina worldwide. The Company’s products are used worldwide in aircraft, automobiles, commercial transportation, packaging, building and construction, oil and gas, defense, and industrial applications.

In the preceding third quarter, the Pittsburgh, Pennsylvania-based company posted a loss of $143 million, or 13 cents a share, compared with a year-earlier profit of $172 million, or 15 cents a share. Excluding restructuring charges, discrete tax items and other special items, earnings from continuing operations in the latest period were three cents a share. Revenue slipped 9.1% to $5.83 billion. Analysts, on average, expected the company to report break-even per-share earnings and revenue of $5.54 billion.

At its last earnings call in October, the company said that it is on track to deliver against its financial and operational targets in 2012. "We're capitalizing on pockets of strong growth and achieving record profitability in our mid and downstream businesses," said Chairman and Chief Executive Klaus Kleinfeld.

The company's results have been hurt recently by a decline in aluminum prices--a result of weak demand in Europe, global uncertainties and excessive production--and higher input costs. To contend with sluggish prices, the aluminum giant said earlier last year that it would slash output by 12% in the U.S. and Europe. Alcoa is also relying more on high-margin end products less vulnerable to slumping metal prices, such as bolts and wheels for cars and airplanes.

Further, Alcoa has taken steps to cut costs and reallign production in order to remain competitive. In April last year, Alcoa announced that it would reduce its annual alumina production capacity by 390,000 metric tonnes, or about 2%, or to align production with smelter curtailments announced earlier last year and to reflect prevailing market conditions.

In OCtober last year, the company said that it continues to execute on curtailments in the upstream business, improving competitiveness and driving toward its stated goal of moving down the cost curve 10 percentage points in smelting and 7 percentage points in refining by 2015.

Full Disclosure: None.

Alcoa Inc. engages in the production and management of primary aluminum, fabricated aluminum, and alumina worldwide. The Company’s products are used worldwide in aircraft, automobiles, commercial transportation, packaging, building and construction, oil and gas, defense, and industrial applications.

In the preceding third quarter, the Pittsburgh, Pennsylvania-based company posted a loss of $143 million, or 13 cents a share, compared with a year-earlier profit of $172 million, or 15 cents a share. Excluding restructuring charges, discrete tax items and other special items, earnings from continuing operations in the latest period were three cents a share. Revenue slipped 9.1% to $5.83 billion. Analysts, on average, expected the company to report break-even per-share earnings and revenue of $5.54 billion.

At its last earnings call in October, the company said that it is on track to deliver against its financial and operational targets in 2012. "We're capitalizing on pockets of strong growth and achieving record profitability in our mid and downstream businesses," said Chairman and Chief Executive Klaus Kleinfeld.

The company's results have been hurt recently by a decline in aluminum prices--a result of weak demand in Europe, global uncertainties and excessive production--and higher input costs. To contend with sluggish prices, the aluminum giant said earlier last year that it would slash output by 12% in the U.S. and Europe. Alcoa is also relying more on high-margin end products less vulnerable to slumping metal prices, such as bolts and wheels for cars and airplanes.

Further, Alcoa has taken steps to cut costs and reallign production in order to remain competitive. In April last year, Alcoa announced that it would reduce its annual alumina production capacity by 390,000 metric tonnes, or about 2%, or to align production with smelter curtailments announced earlier last year and to reflect prevailing market conditions.

In OCtober last year, the company said that it continues to execute on curtailments in the upstream business, improving competitiveness and driving toward its stated goal of moving down the cost curve 10 percentage points in smelting and 7 percentage points in refining by 2015.

Full Disclosure: None.